Get In Touch

We’d love to hear from you.

- We do training, speaking, consulting, and embed UX Contractors directly in your organization.

- Questions or Comments?

-

100 More Things #200: EVEN SOPHISTICATED TECH USERS WANT SIMPLICITY

We have a tendency as designers to assume that the more sophisticated people are about technology, the more complicated they want their technology to be. But if you think about the most popular technologies they are often the most simple. For example, some apps use…

-

100 More Things #199: VR CAUSES SENSORY CONFLICTS

If you’ve experienced virtual reality then you may have also experienced feeling nauseous from virtual reality. As VR has changed and improved, so have some of the side effects, such as nausea. But there are still situations in which VR can make people nauseous. Technology…

-

100 More Things #198: PEOPLE PROCESS SENSORY DATA UNCONSCIOUSLY

Jason is 20 years old and he’s deaf. He puts on a special vest that’s wired so that when it receives data, it sends pulses to his back. The vest is connected to a tablet. When I say the word “book” into a microphone that…

-

100 More Things #197: PEOPLE NEED FEWER CHOICES

The research is clear that people like having a lot of choices, but that providing a lot of choices not only makes it harder for them to take action, but may also induce stress. Designers often make decisions based on preference, not performance. Many designs…

-

100 More Things #196: GAMES CAN IMPROVE PERCEPTUAL LEARNING

I was pretty strict with my children about video games when they were growing up. Because I had never been a gamer I somehow decided it wasn’t good for my children to spend time playing video or online games. We never owned a game console,…

-

100 More Things #195: PEOPLE LOOK BELOW “THE FOLD”

For quite a while there has been a back and forth in interface design about whether scrolling is a “good” or usable choice. If you have a lot of information or content on a page, should you present it all on one page and have…

-

100 More Things #194: PEOPLE WANT TO SKIM AND SCAN VIDEOS

Video has become such an important medium online, yet video interface design is given surprisingly little attention. We have special devices and software for presenting text and images, but it seems we think of videos as being something we embed on a page, but can’t…

-

100 More Things #193: WHEN TODDLERS LAUGH, THEY LEARN MORE

Let’s say you decide to let your 18-month-old daughter play some learning games on your tablet. You have a couple of apps you’ve downloaded and you’re trying to decide which one to give to her: The one that introduces number and letter concepts with music…

-

100 More Things #192: FOR MANY CHILDREN TECH USE STARTS BEFORE THE AGE OF 2

The Pew Research Center surveys parents in the US to get information on technology use for children ages 0 to 11. Here are some of the recent findings: Almost half of the children below the age of 2 regularly use a smartphone. The number is…

-

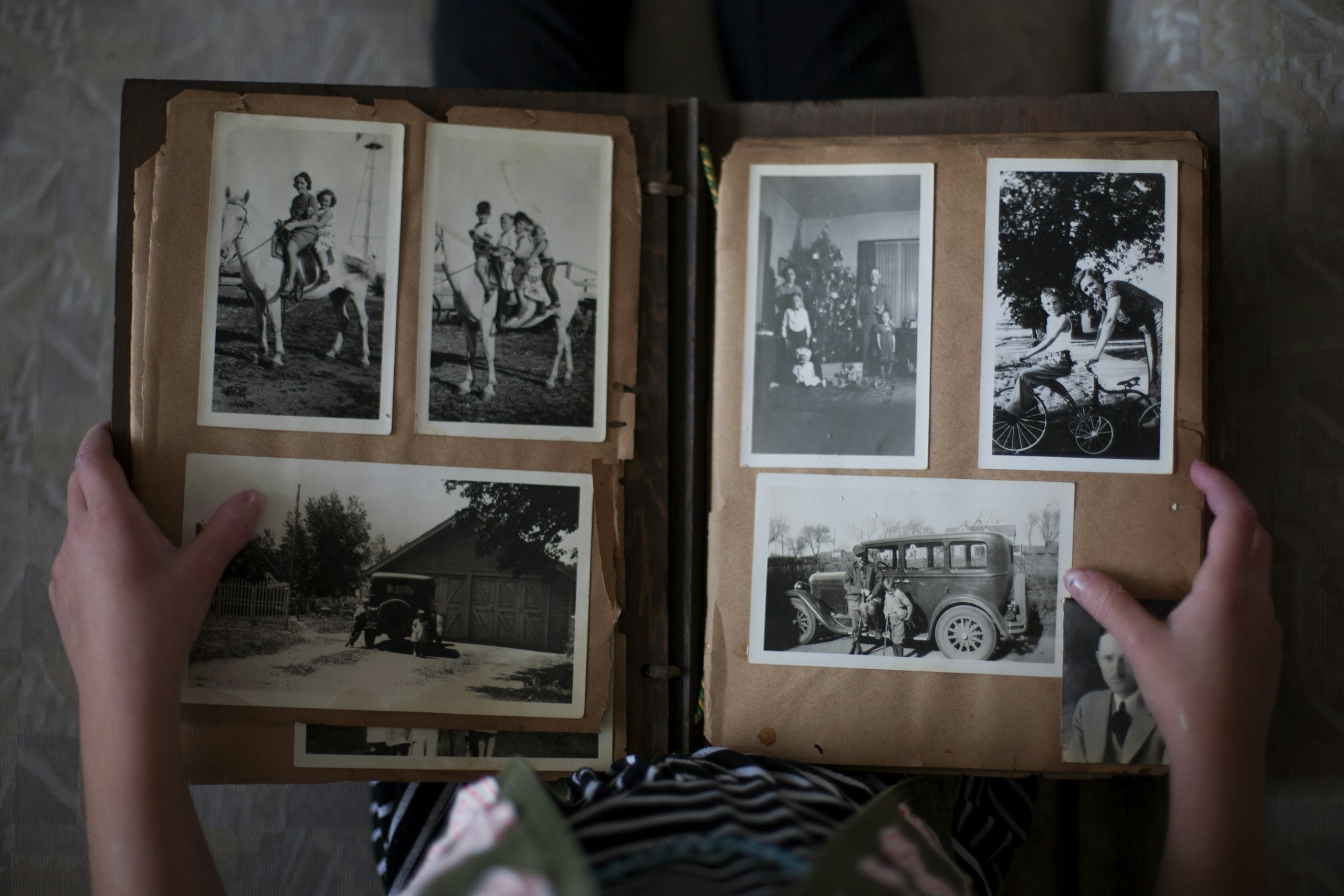

100 More Things #191: AS PEOPLE AGE, THEY BECOME LESS CONFIDENT ABOUT THEIR OWN MEMORIES

If I told you that as people age their neuroplasticity declines—as they get older, they’re less able to learn new things, create new neuronal connections, and retrieve memories—you’d probably nod and say, yes, you’ve heard that’s true. It’s a piece of conventional wisdom that everyone…